What strange times we live in. Each night, the news bulletin starts off with the financial report, extending over about ten minutes, then briefly the “other” news, then a return to the usual financial report, sport and weather. Each morning I unwrap the paper and marvel at the increasing size of the headlines reporting on the latest falls on the Australian Stock Exchange, or Wall Street, or the FTSE, or the Hang Seng. How do I even know about such entities? I think it’s probably indicative of the recent financial bubble that we’ve all been caught up in over the past 10 years, that even before this crisis, every news bulletin has the financial report as a staple item each night- I really don’t particularly remember it having such prominence, say, twenty years ago. Ah, but we’re all investors now-unwittingly and sometimes unwillingly through our compulsory superannuation, and cajoled to “unlock the equity in your home” by drawing back on our mortgages to spend on the sharemarket.

And of course, it’s all on such a global scale. There’s no shutdown period at all on a sharemarket somewhere- Australia wakes up and looks at what America has done overnight, responds by a rise or a fall on the ASX, the day moves on, that night the UK market responds, the US market responds to that, and it all goes around again. There’s no sigh of relief of “thank God that’s finished”- although at least the weekend allows a global breather, until the whole merry-go-round starts again on Monday.

Our whole system is predicated on credit in a way that is largely unconscious and invisible to us. With just-in-time manufacturing, there are no storehouses any more of goods waiting to be sold- instead the credit system balloons forward to buy in a consignment as it is needed right now, retracts when it’s sold only to balloon out again to replenish the shelves next week. We’re bombarded with “buy now, no deposit!!” advertising; we’re asked as a matter of course for every transaction with a swipe card “will that be on credit?”

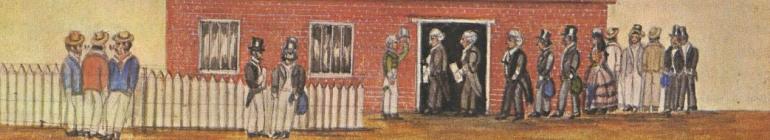

And so, conscious of all this, I’ve been thinking about the recession (depression?) in the early 1840s in Port Phillip, and the way it impinged on the worldview of people there at the time. I surmise that, like me, their understanding at the time was incomplete:no doubt more so, given the four-month delay in any information from Britain compared to our instantaneous communications now, and the dependent state of a colonial economy within the Empire as a whole. What they understood of the financial situation was filtered through the newspapers, gossip, and lived economy of their own experience.

Contemplation of this- and I’m doing quite a bit of reading on this which I shall, dear reader, share with you- is not completely irrelevant to my Judge Willis thesis work. As sole Resident Judge, he heard all of the civil cases that came to the Supreme Court; he oversaw (but was not directly involved in) the Insolvency Court, and his own propensity to “sift to the bottom of things” characterized his approach to the bankruptcy cases that crossed his bench. I feel sure that the general ‘anxiety’ and ‘excitement’ of Port Phillip reflected both the economic and political currents of the day, and directly fed into his dismissal.

So how did the Port Phillip communications of the day portray the financial crisis? Newspapers had always carried a column showing the price of goods on the local market -wheat, bread, spirits, sperm candles, parsnips etc. (The parsnips have particularly taken my attention because at my local supermarket they have been $5.95 per kilo for the last few months. For bloody parsnips!!!!! Fine words may butter no parsnips, but obviously $5.95 a kilo will!) The shipping reports were often followed by correspondence from the wool agents in London, reporting on the wool sales- generally chiding the Australian suppliers for lack of quality, and sighing at the dearth of buyers.

Much of a four-page Port Phillip newspaper of the 1840s was devoted to Court reports, and as the judicial system expanded in Port Phillip, so did the scope for court reporting- the Supreme Court, the Insolvency Court, the Police Bench, Quarter Sessions, the Court of Requests. The tales of drunkenness and violence that ran through these courts were increasingly supplemented by stories of insolvency, defections from debt, unemployed immigrants, forced sales etc. as we move from 1841 into 1842.

And increasingly as we move from late 1841 into 1842 there are also the required advertisements of bankruptcy posted in the newspaper, notifying of the first, second or third creditors’ meeting of one bankrupt after another. By April 1842 (which is where I’m up to at the moment), the Port Phillip Herald regularly published a table of insolvent debtors, their assets and liabilities, and the dates of their scheduled meetings with creditors. Real estate advertisements spruiked “we’re at the bottom of the market- so buy now!!” . Occasionally there would be a high-profile insolvency case that demonized a particular individual, surely read and gossiped about with a sense of schadenfreude by the subscribers to the newspaper.

And all of this occurred within the bullishness and heightened expectations of people who thought they were coming to “Australia Felix” to make their fortunes!